“I’m not long your house anymore”

Mortgage-backed securities (MBS) are back in the headlines and the next financial crisis supposedly imminent. While the latter statement is debateable, one thing we know for sure is that understanding MBS and their role in the collapse of Silicon Valley Bank (SVB) can provide valuable insights into how tokenization can help prevent future banking crises. Learn how you can harness the full potential of the technology.The recent failure of Silicon Valley Bank (SVB) could have a lasting impact on mortgage-backed securities (MBS) markets.

According to Morgan Stanley analysts, the effect may not be on the securities that investors are most worried about.

The analysts suggest that even the safest corners of mortgage markets could see permanently lower valuations. This prediction sheds light on agency MBS markets and the way banks manage their balance sheets. The agency MBS markets, which involve mortgages on single-family homes and multi-family apartment buildings, are largely dominated by banks. As banks reduce their exposure to these markets, the impact will be felt by homeowners and investors.

After the run on SVB, banks may be forced to reduce their holdings of US-mortgage-backed securities that are guaranteed by Fannie Mae and Freddie Mac. These bonds have high duration and experience significant losses when interest rates rise. Therefore, banks may want to reduce their exposure to such securities, leading to a negative impact on agency MBS markets.

What are mortgage-backed securities?

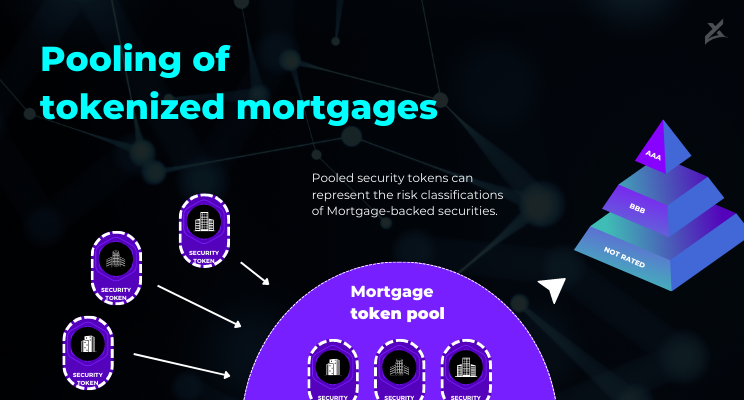

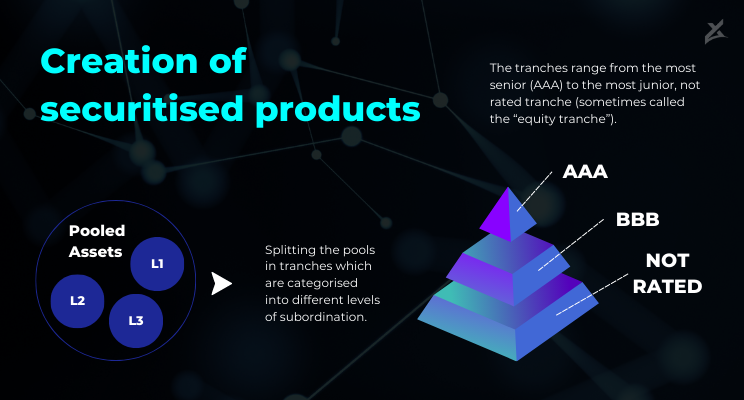

MBS are formed through securitization, a financial method that involves consolidating diverse mortgage loans into a single pool. The cash flows generated by these mortgages are then divided into tranches, each with its own credit rating, which reflects the level of risk associated with that tranche. These tranches are subsequently transformed into tradable securities, known as MBS, allowing investors to buy and sell them in the financial markets as debt instruments, with varying degrees of risk and reward.

The global market for MBS is significant, but the US MBS market is one of the world's largest and most liquid fixed-income markets. Its outstanding securities total approximately €9.8 trillion. In contrast, the EU securitization market has a notional amount of around €0.7 trillion. This difference mainly reflects structural features of the US securitisation market.

MBS - as the downfall of SVB

In the last months the financial landscape became increasingly volatile, the latest incident involving SVB provides a cautionary example of the potential real estate-related risks in the current market. SVB, a prominent financial institution, invested in a $120 billion portfolio of highly rated government-backed securities, including $91 billion in fixed-rate mortgage bonds with an average interest rate of just 1.64%. However, when the US Federal Reserve started to raise rates, the value of the portfolio fell significantly, leaving SVB with an asset/liability mismatch. This was mainly due to the fact that the institution had invested in longer-term mortgage securities with maturities of more than 10 years.

This example is a striking illustration of the current market situations relevance, as the risks associated with rising interest rates become more apparent. With a massive $1.5 trillion wall of debt looming for US commercial properties alone, the market is exposed to substantial refinancing risks in the coming years. These potential disturbances could leave many institutions, not just SVB, vulnerable to financial setbacks.

In the face of increasing market volatility and the growing threat of refinancing risks, financial institutions, real estate investors and asset managers must not only closely monitor market trends but also adapt innovative digital solutions to effectively manage their portfolios. By leveraging cutting-edge technology and data-driven insights, these institutions can mitigate the potential impact of refinancing risks and asset/liability mismatches, ensuring greater stability and resilience in an uncertain economic landscape.

How tokenization helps to prevent future SVB’s?

The failure of Silicon Valley Bank has emphasized the importance of finding new solutions to prevent future banking crises. Tokenization offers a promising tool to create efficient and flexible investment structures, that help real estate investors, asset managers and mortgage banks to restructure their real estate investments. In addition the tokenization of mortgages and other real estate investment structures can help to increase overall market transparency and liquidity.

Tokenization involves the representation of mortgages or real estate as security tokens on the blockchain. Every security token has the capacity to integrate a wide-ranging dataset, safely stored on the blockchain, encompassing diverse types of information, including mortgage-related, legal, or property-related data.